48+ what percentage of income should go to mortgage

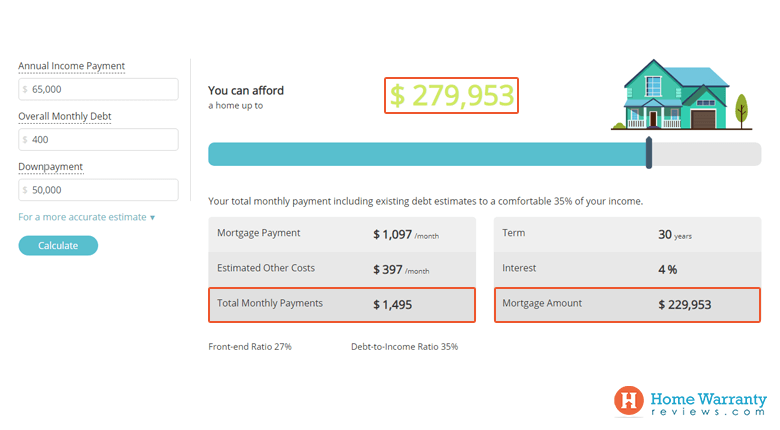

For example if your monthly salary is 4000 your. Web Other mortgage-to-income budgeting considerations.

What Percentage Of Your Income Should Go To Mortgage Chase

Web A 15-year term.

. Web The 3545 model. There are four common models prospective homebuyers use to calculate the percentage of income. This rule says that you should not spend more than 28 of.

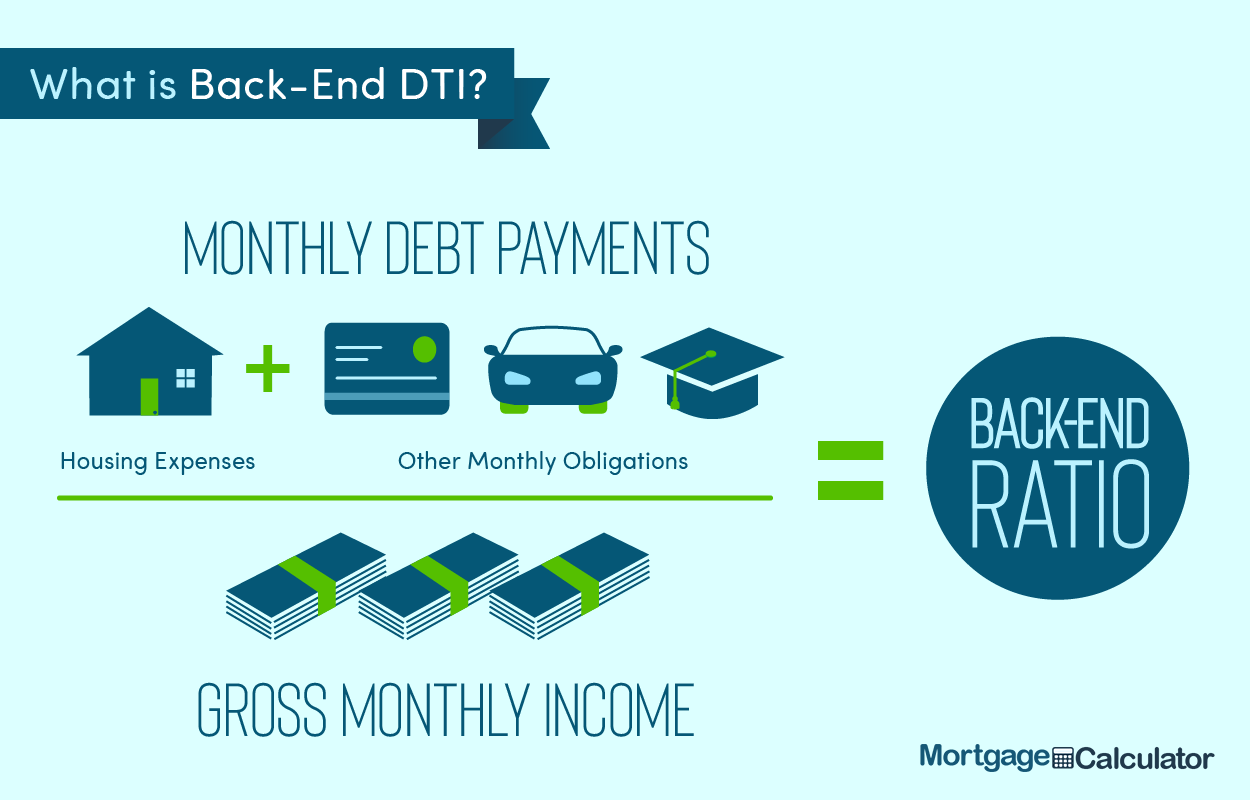

The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. Apply Get Pre-Qualified in 3 Minutes. Web What Percentage of Income Should Go to Mortgage.

Web 48 what percentage of income should go to mortgage Kamis 23 Februari 2023 A lender suggests to not. Web But there are two other models that can be used. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web A fairly established and well-known piece of wisdom the 28 rule also known as the 2836 rule advocates that homeowners should spend 28 of their gross. Web How Much Of My Income Should I Be Using To Pay Off Debt. Compare Offers From Our Partners To Find One For You.

Ad Calculate Your Payment with 0 Down. Ad 5 Best House Loan Lenders Compared Reviewed. Web Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and.

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Web Keep your mortgage payment at 28 of your gross monthly income or lower Keep your total monthly debts including your mortgage payment at 36 of your. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Web The Rule states that a household should not spend more than 28 percent of its gross monthly income on housing-related expenses. Web By law lenders are prohibited from making mortgages that take up more than 35 percent of your monthly income. And you should make.

Best Mortgage Lenders in California. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Ad Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value.

Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage. Its not a loan its a home equity agreement. In addition to mortgage.

While its suggested that up to 28 of your pre-tax income go toward your mortgage everyones financial situation and goals. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment.

Ad 5 Best House Loan Lenders Compared Reviewed. Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. Web What portion of your income should go to your mortgage.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Best Mortgage Lenders in California.

Ad Compare Home Financing Options Get Quotes. Apply Get Pre-Qualified in 3 Minutes. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Comparisons Trusted by 55000000. Comparisons Trusted by 55000000.

The 3545 Rule The 3545. Web As a general rule of thumb your monthly housing payment. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage.

Use Our Tool To Find Out If You Qualify.

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

What Percentage Of Your Monthly Income Should Go Toward Your Mortgage Sapling

How Much Of My Income Should Go Towards A Mortgage Payment

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Disaster Covid 19 Business Lending Grants State Federal 21 501 Vermont Small Business Development Center

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

How Much Home Can You Afford Advanced Topics

4 Yates Road Manalapan Nj 07726 Mls 22224294 Howard Hanna

Home Affordability Calculator

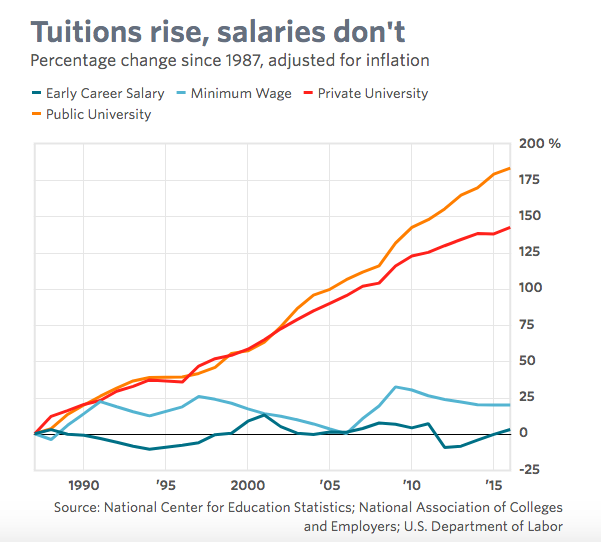

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

What Percentage Of Your Income To Spend On A Mortgage

The Percentage Of Income Rule For Mortgages Rocket Money

Percentage Of Income For Mortgage Rocket Mortgage

Mortgage And Rental Income Calculator Excel Template Step By Step Video Tutorial By Simple Sheets Youtube